Ranking your credit score is important when it comes to having a loan, whether it's from a financial institution or any sort of home mortgage company. One point that is inspiring is that if you have a lowered credit score, you can repair it with a little credit monitoring and a research report. Right here, I'm sure I'm going to take you through some simple steps to find out what your score is and how you can easily fix it.

1. You can spend on a credit watch membership that tells you what your credit score is, but it's going to cost you a monthly fee, so that's the cheapest and best way to do it, particularly if you want to get a loan from some guy to get a car loan. And if the financial institution or company that you use is rejected, it will certainly let you know what your credit score is.

2. As soon as you've decided what your credit score is, go online and find out your additional credit history. This will undoubtedly reveal to you what is being placed on your credit, and from there you will definitely know which locations you need to work with.

3. Now that you have understood what is impacting your credit, you should contact the company for which you have an exceptional balance, and many of them will allow you to pay until you have paid them in full. Ask the company when you actually paid them if they would give proof of the agreement to the three main credit bureaus, such as Equifax, TransUnion, and Experian.

4. At the moment, if the company says it can't give your condition to the credit agencies, then ask if they will actually send you a letter saying that you have actually paid your bills; most companies will definitely do that for you. When you get these letters, speak to these three major credit bureaus and file a lawsuit with them or ask for a phone number or a postal address to ensure that you can give them letters specifying that you have already paid your bills.

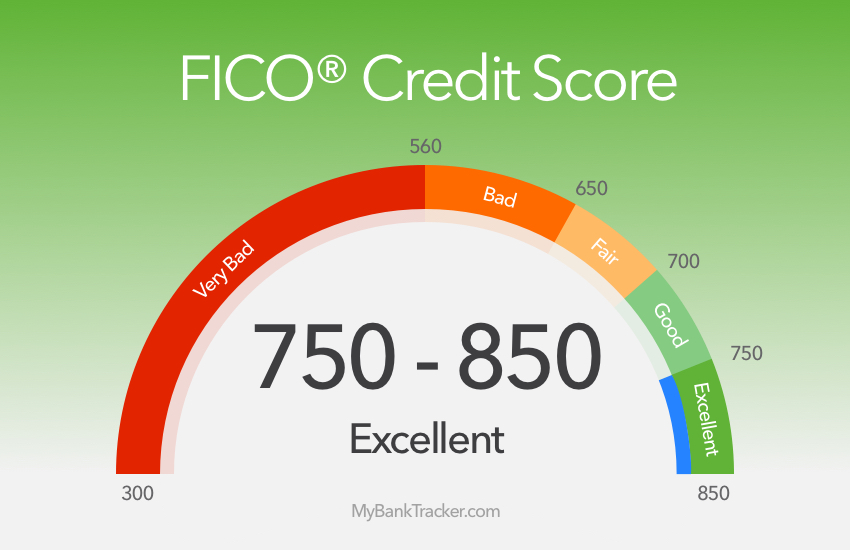

Also, check about max credit score

If you have done all of these actions, you may find that your credit score has improved and that you will be eligible for any potential loans that you may require.

One point that is inspiring is that if you have a lowered credit score, you can repair it with a little credit monitoring and a research report. You can pay for a credit watch membership that will undoubtedly tell you what your credit score is which will undoubtedly cost you a monthly charge, which is why it's the best and completely free point to make, particularly if you're trying to get some kind of La Financing you need to get ahead and use it for a car loan as well. If you've already worked out what your credit score is, go online and use it for your additional credit record as well.

No comments:

Post a Comment